Below table compares ShaBaas Pay Stripe and PayPal across fees settlement speed payment methods and chargeback risk for Australian businesses.

Key Takeaways

Australian businesses have access to many payment platforms but not all are built for the same outcomes.ShaBaas Pay is designed for Australian domestic payments using real time bank rails while still supporting cards and wallets.Stripe and PayPal are global platforms built primarily on card and wallet networks.For Australian invoicing and service businesses real time bank payments provide faster settlement lower fees and clearer cash flow.

Why this comparison matters for Australian businesses?

Most payment comparisons focus on features but overlook what matters most day to day for Australian businesses. That is how quickly money reaches the bank account how much it costs to process each payment and how easy it is to understand what has been paid and what is still outstanding.

ShaBaas Pay, Stripe and PayPal all enable businesses to accept payments. The difference lies in the underlying rails they use and the impact this has on cash flow cost and operational clarity.

Fees and profit margins

The problem

Stripe and PayPal rely on card networks such as Visa and Mastercard. These networks introduce interchange and scheme fees which are passed on to merchants. For Australian businesses this typically results in fees ranging from around 1.75 percent to more than 3 percent per transaction.

For high value invoices these fees add up quickly and directly reduce profit margins.

The ShaBaas Pay approach

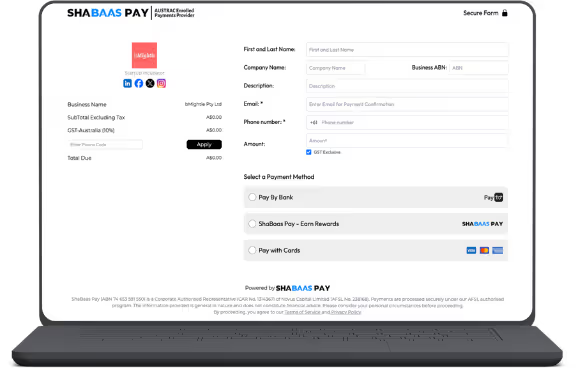

ShaBaas Pay uses the Australian New Payments Platform through PayID and PayTo. By bypassing card networks for domestic payments ShaBaas Pay significantly reduces processing costs.

For example on ten thousand dollars processed through cards a business may pay around one hundred and seventy five dollars or more in fees. With real time bank payments that cost is materially lower while still providing confirmation and security.

Card and wallet payments are still supported via eway for customers who prefer them ensuring coverage without forcing businesses into higher cost rails by default.

Cash flow and settlement speed

The problem

Card based platforms often delay settlement to manage their own risk. Even after a customer pays funds may not reach the business account for several days. This delay creates uncertainty and increases reliance on forecasts rather than actual balances.

The ShaBaas Pay approach

With real time bank payments funds are settled into the business bank account seconds after the customer authorises the payment. There are no holding periods and no settlement delays.

This allows business owners to make decisions based on what has actually been received rather than what is expected to arrive later.

Security and chargebacks

The problem

Card and wallet payments are vulnerable to disputes and chargebacks. Customers can raise disputes weeks after a transaction creating revenue risk and administrative overhead for businesses.

The ShaBaas Pay approach

PayID and PayTo payments are authorised directly inside the customer banking app. This significantly reduces the risk of friendly fraud and chargebacks providing greater certainty for businesses.

Card and wallet payments via eway follow established security and compliance standards ensuring coverage where required without compromising the core bank first model.

Use case scenarios

Best for high value invoicing

ShaBaas Pay

Consultants agencies and wholesalers benefit from lower percentage fees and instant settlement when processing large invoice amounts.

Best for Australian service businesses

ShaBaas Pay

Accountants tradies coaches and professional services invoicing Australian clients benefit from real time settlement and improved cash flow visibility.

Best for global ecommerce

Stripe or PayPal

Businesses selling primarily to overseas customers may prefer global card acceptance and wallet coverage.

Final Thoughts

Stripe and PayPal remain strong platforms for international and card centric use cases. However for Australian businesses focused on domestic invoicing services and predictable cash flow real time bank payments offer a faster clearer and more cost effective way to get paid.

ShaBaas Pay is built to prioritise real time bank payments while still supporting cards and wallets where required. This gives Australian businesses full payment coverage without sacrificing speed clarity or margins.

.svg)